Dr. James Tansey of UBC Sauder School of Business has just published a study blaming red tape, and not foreign buyers, for Vancouver’s housing affordability crisis1)Growing Pains: Density, economic growth, sustainability and wellbeing in Metro Vancouver. Given that a recent “study” by Prof. Andrey Pavlov of SFU Beedie School of Business turned out to be a inaccurate, I decided to take a closer look at Dr. Tansey’s work.

Here’s Dr. Tansey’s central conclusion (page 3):

The effect of regulation and zoning constraints in the housings sector is six times larger than the effect of speculators, according to [sic] and the largest group of property investors who by[sic] to rent is actually older domestic owners who are seeking financial returns in a low interest rate environment.

It’s not entirely clearly immediately whom Dr. Tansey is citing as the source for the claim that red tape is the main reason for the housing crisis. The answer is found on page 16:

A more detailed bottom-up analysis by property and tax experts Burgess Cawley Sullivan suggested that taxes and development fees represent $220,256 to the cost of an $840,000 apartment and $337,582 of the cost of a $1.4m three bedroom apartment.

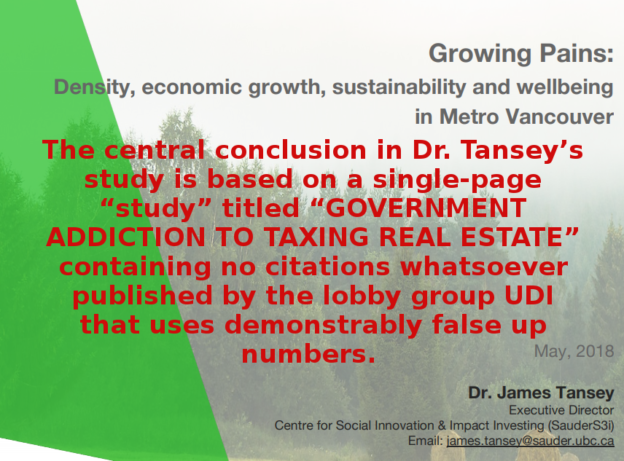

As the citation for the “more detailed bottom-up analysis by property and tax experts Burgess Cawley Sullivan,” Dr. Tansey has provided a link to a single-page “report” published by the development industry lobby group Urban Development Institute2)GOVERNMENT ADDICTION TO TAXING REAL ESTATE titled GOVERNMENT ADDICTION TO TAXING REAL ESTATE.

That’s two red flags in one: A single-page “study” with a biased title with no citations whatsoever published by a lobby group. Dr. Tansey would not risk his academic reputation on such a flimsy document, so, I thought that surely he must have thoroughly vetted the “study” for its veracity.

The UDI study purports to depict the breakdown of taxes and other government fees associated with a “Typical Cambie Corridor Assembly Project”. The authors state that the the Community Amenity Contribution(CAC) is $115 per square foot of buildable area of net additional density. They don’t cite a sources for this figure, and, it soon becomes apparent why.

The City of Vancouver published3)COMMUNITY AMENITYCONTRIBUTIONS – THROUGH REZONINGS exactly how much the CAC is for the Cambie Corridor. It is $68.18 per square foot.

In sum, the central conclusion in Dr. Tansey’s study is based on a single-page “study” with a biased title with no citations whatsoever published by a lobby group that uses made up numbers. In the words of Carl Sagan “Extraordinary claims require extraordinary evidence”. Dr. Tansey’s extraordinary claim is backed by demonstrably false evidence. We can safely conclude Dr. Tansey’s study is nothing but junk science.

Update

A kind reader has pointed out to me that there’s another glaring error in the UDI “study”. Empty Homes Tax applies to neither “property undergoing redevelopment” nor “under review for redevelopment of vacant land.”4)Will your home be taxed?

References

Thanks for looking at the study. I could have been a bit more clear with the references. I was referring to the CMHC study Escalating House Prices from 2018 not the study by Burgess Cawley Sullivan (considered to be the top appraisal company in BC by some) that UDI quoted. That study is a bottom up review of the total impact of development fees. CMHC’s model was a national macroeconomic model.

So your assertion isn’t correct. I’m quoting CMHC, not the study UDI quoted.

CMHC doesn’t “The effect of regulation and zoning constraints in the housings sector is six times larger than the effect of speculators”.

CHMC report Page 102:

“The explanatory contribution of each variable is shown in Figure 41. The fixed effect accounts for 36 per cent of the forecasting errors, while the interaction term between regulation constraints and national house prices accounts for 30 per cent. Speculation and investor demand for properties account for 5 per cent of the forecasting errors.”

All that it says is:

The effect of “the interaction term between regulation constraints and national house prices” on *forecasting the error* is six times larger than “speculation and investor demand”.

And they’re not indepedent of each other either, as explained in CMHC P101:

“The interaction term between regulation constraints and speculation has a significant

effect on housing prices, suggesting that the impact of speculation on prices increases with the degree of regulation constraints, or that *the impact of regulation constraints on house prices is more pronounced when there is speculation*”

Hello, everything is going nicely here and ofcourse every one is sharing data, that’s

truly fine, keep up writing.

Vitamin B7, more commonly known as biotin, is a B vitamin. Like all B vitamins, biotin aids the body in breaking down carbohydrates, fats, and proteins for energy production. It also has roles in maintaining healthy skin, hair, and nervous system function.

Can you take too much biotin