Yesterday, I demonstrated1)UBC report blaming red tape for housing crisis is based on lobby group report containing demonstrably false numbers that the report3)Growing Pains: Density, economic growth, sustainability and wellbeing in Metro Vancouver by Dr. James Tansey of UBC Sauder School of Business blaming red tape instead of foreign speculators has used a demonstrably false report as basis for estimating the impact of government regulations on housing prices.

Today we look at the second half of Dr. Tansey’s claim, i.e., that foreign buyers are having little impact on housing prices.

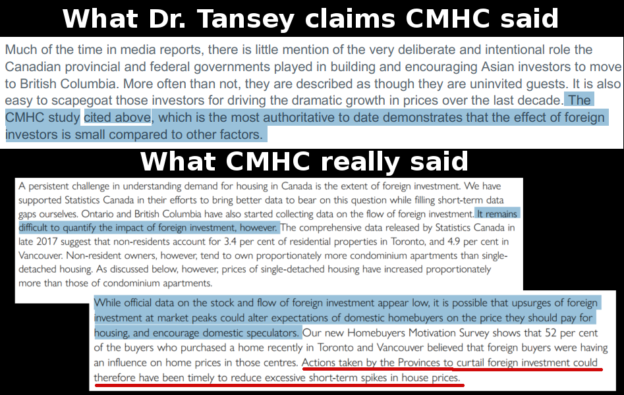

Here’s Dr. Tansey’s exact claim:

The CMHC study cited above, which is the most authoritative to date demonstrates that the effect of foreign investors is small compared to other factors.

The CMHC study Dr. Tansey is referring to is the report from earlier May 2018 titled *Examining Escalating House Prices in Large Canadian Metropolitan Centres*2)Examining Escalating House Prices in Large Canadian Metropolitan Centres .

Here’s what the report actually says about foreign buyers (emphasis mine):

A persistent challenge in understanding demand for housing in Canada is the extent of foreign investment. We have supported Statistics Canada in their efforts to bring better data to bear on this question while filling short-term data gaps ourselves. Ontario and British Columbia have also started collecting data on the flow of foreign investment. It remains difficult to quantify the impact of foreign investment, however. The comprehensive data released by Statistics Canada in late 2017 suggest that non-residents account for 3.4 per cent of residential properties in Toronto, and 4.9 per cent in Vancouver. Non-resident owners, however, tend to own proportionately more condominium apartments than singledetached housing. As discussed below, however, prices of single-detached housing have increased proportionately more than those of condominium apartments.

While official data on the stock and flow of foreign investment appear low, it is possible that upsurges of foreign investment at market peaks could alter expectations of domestic homebuyers on the price they should pay for housing, and encourage domestic speculators. Our new Homebuyers Motivation Survey shows that 52 per cent of the buyers who purchased a home recently in Toronto and Vancouver believed that foreign buyers were having an influence on home prices in those centres. Actions taken by the Provinces to curtail foreign investment could therefore have been timely to reduce excessive short-term spikes in house prices.

Dr. Tansey is being intellectually dishonest by claiming that the CMHC study ”demonstrates that the effect of foreign investors is small compared to other factors.” CMHC report admits that it’s difficult to gauge the impact, and suggests that even if the foreign buyer numbers are low, foreign buyers could be punching above their weight by altering the expectations of local buyers. CMHC even concludes that the BC’s and Ontario’s foreign buyer tax may have been a timely measure to cool down housing prices.

References

The section of the report you highlight is not the one I was referring to. In the section you highlight CMHC is taking about the way that he perception of buyers about the role of foreign buyers can influence their behaviour. The relevant sections of the report are:

P103: ‘Among these factors, the most important contributors are the CMA dummy and regulation/ geographic constraints of land use, while speculation and investor demand account for approximately 5 per cent of the forecast errors according to the model’

And

P101: ‘The fixed effect accounts for 36 per cent of the forecasting errors, while the interaction term between regulation constraints and national house prices accounts for 30 per cent. Speculation and investor demand for properties account for 5 per cent of the forecasting errors.’

And

P95: ‘While other potential elements are found to play a role, differences in land supply available for new homes are found to be the most significant factor explaining price fluctuations. This result requires careful interpretation, as it may indicate a shift in the composition of supply toward condominiums.• Other potential explanations such as investor demand and speculative activity appear to have more limited impacts on prices over the long term.’

Here’s D.r James Tansey’s claim:

“The CMHC study cited above, which is the most authoritative to date demonstrates that the effect of foreign investors is small compared to other factors.”

Here’s what CMHC says (P57):

“At this stage, we have not undertaken comprehensive research to evaluate the impact of foreign investment on housing

prices, mainly because these data were not available. ”

Dr. James Tansey’s claim that “The CMHC study cited above, which is the most authoritative to date demonstrates that the effect of foreign investors is small compared to other factors.” is a barefaced lie as CMHC clearly states that “we have not undertaken comprehensive research to evaluate the impact of foreign investment on housing prices.”

CMHC did not use foreign buyers as a variable in their models. The CMHC report cannot be used to make draw any conclusions about the “the effect of foreign investors is small compared to other factors.” as Dr. Tansey has done here.

In fact, CMHC acknowledges that even if the number of foreign buyers is small, its impact can be vastly amplified as foreign buyers alter domestic buyers’ price expectations.

CMHC P6:

“While official data on the stock and flow of foreign investment appear low, it is possible that upsurges of foreign

investment at market peaks could alter expectations of domestic homebuyers on the price they should pay for

housing, and encourage domestic speculators. Our new Homebuyers Motivation Survey shows that 52 per cent

of the buyers who purchased a home recently in Toronto and Vancouver believed that foreign buyers were having

an influence on home prices in those centres.”

There is a further definitional challenge at play here which makes the CMHC’s findings on foreign investment largely useless in rebutting the concerns of those who have hypothesized that offshore capital has likely played a significant role in housing prices.

As I recall, the CMHC report, insofar as it tries to estimate foreign investment with the incomplete data you mention, uses a definition of foreign investment where the buyer is foreign, ie: they have no Canadian residency or citizenship/immigration standing.

What most critics who have researched this area argue (David Ley, Josh Gordon, Tom Davidoff, etc) is that it is foreign capital that has had an outsized impact on the market. A buyer might be a landed immigrant or Canadian citizen, but earns income and pays taxes on that income abroad. This would inflate housing prices at the same time as it constrains Canada’s ability to fund the services needed for its population. We know that the 10% of Vancouver’s population that arrived here under the Investor Immigrant Program pay less tax on average than those who arrived as refugees, and far less than those born in Canada or immigrants who came under the skilled worker category. What we are unable to determine is the extent of wealthy tax avoiders whose income has been offshored but who are in other categories (eg: Canadians born in Canada). We only get a hint of this through the revelations like the KPMG Isle of Mann case and the Panama document dump. There is a strong incentive to obscure this activity to officials, so even though we know this activity exists, it would be very challenging to determine the scope conclusively.

So, is Dr. Tansey correct that “foreign buyers” as defined by CMHC are a small part of the market’s driving forces?

Probably.

Is that what intelligent people mean when we talk about the influence of offshore money on the local real-estate market?

No.

The CMHC report would have defined the stereotype of the investor immigrant homemaker who invests many millions in Vancouver real estate as domestic demand and considered it part of the case that shows we need more supply just as they would define demand from a sixth generation Canadian high net worth individual who took advantage of offshore tax havens while declaring poverty level Canadian income part of local demand. Both are using offshore capital disconnected from local incomes, likely while not contributing to Canadian civil society in the way envisioned by our taxation system. Indeed, they would likely be a net cost to the system.

Incidentally, I believe we do need more supply and that foreign money is not the only factor in our current situation. Low interest rates, the ‘get in before its too late’ mentality catalyzed by foreign capital flows and yes, the double cohort of having boomers and millennials in the market simultaneously, etc. all play a role. But the fact is that we haven’t got data that prove conclusively the impact that offshore money has little impact on the outcomes we see today.