Rental rebate funded by Airbnb fines to help renters facing 4.5% increase

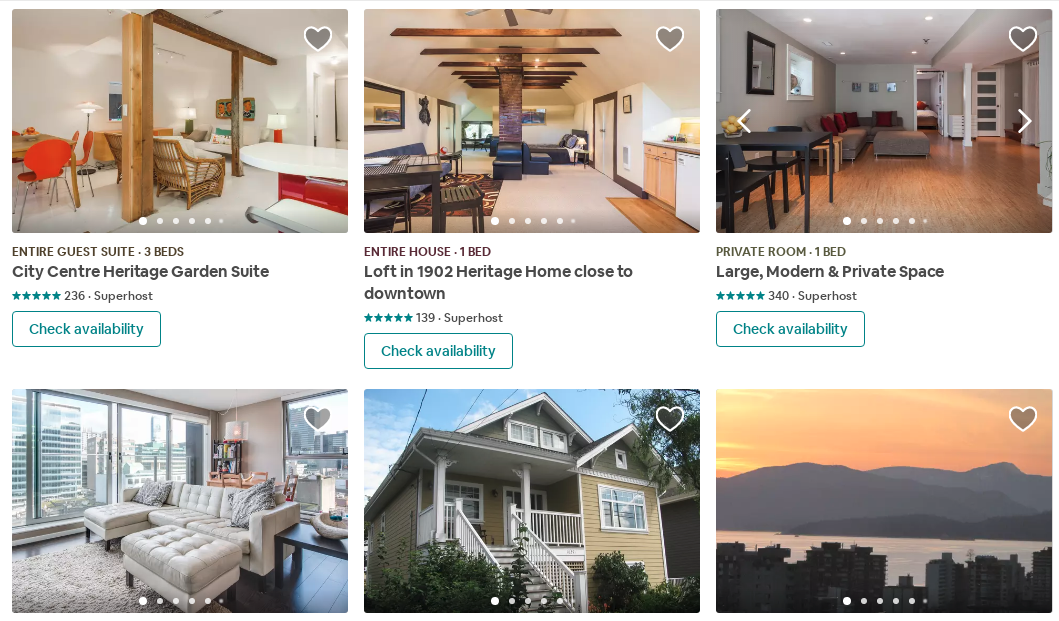

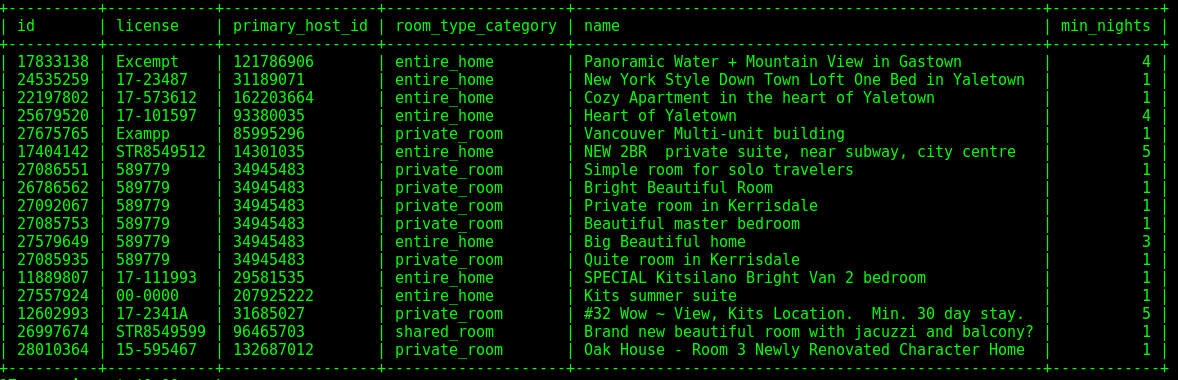

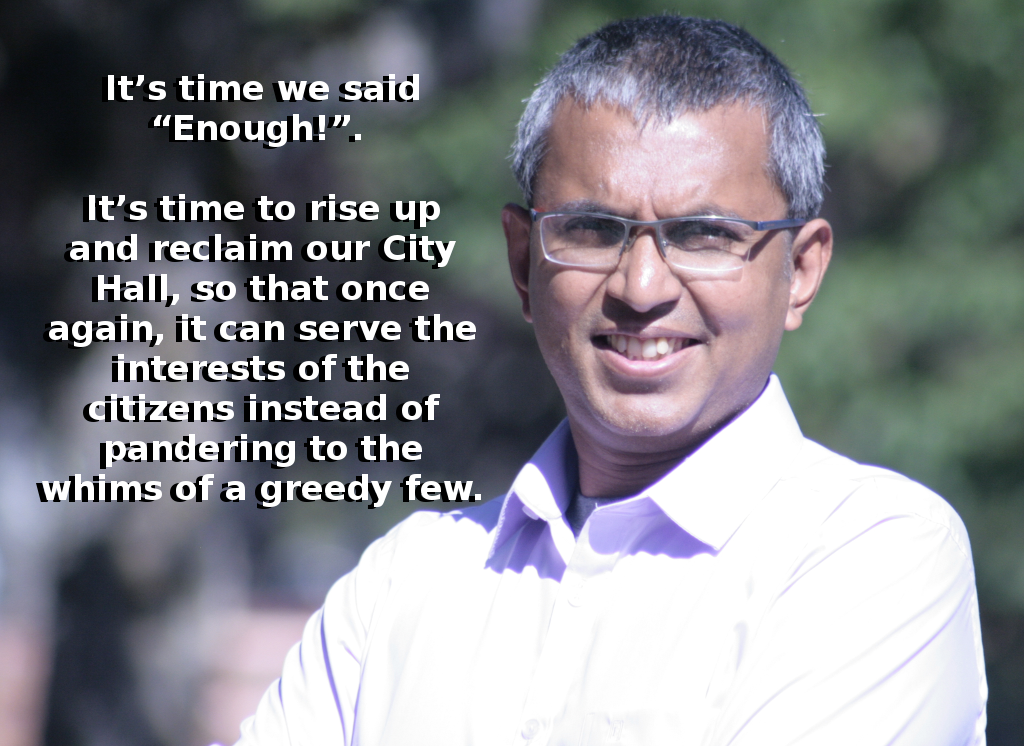

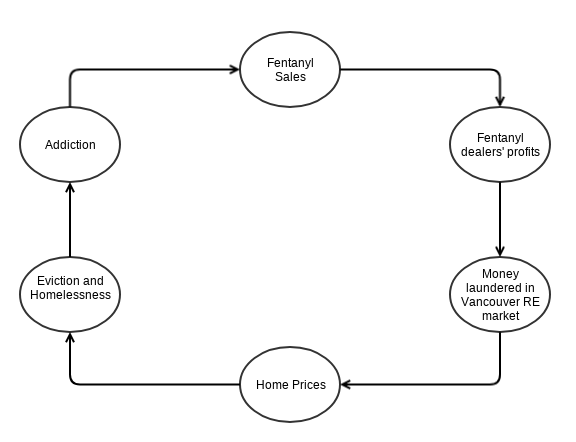

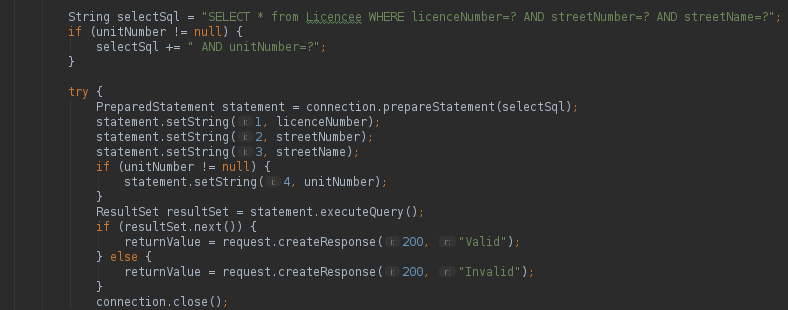

The 4.5% allowable rent increase for 2019 announced by the BC government will hit Vancouver renters hard. I pledge to offer Vancouver’s renters a rental rebate financed by Airbnb fines. Such a move would help rental households without burdening either the Vancouver taxpayers or our city’s landlords. The latest Airbnb scan I conducted last night […]

Read More →