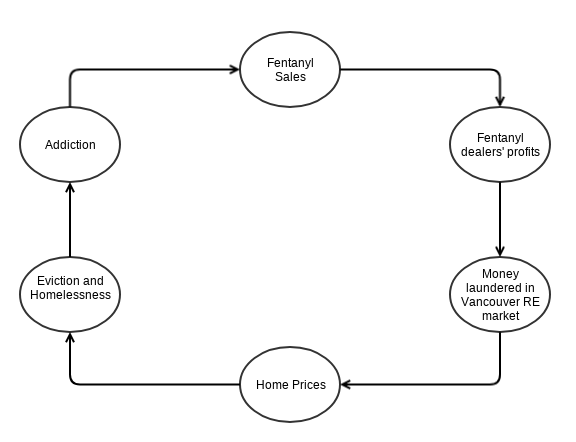

Fentanyl/Real Estate Cycle

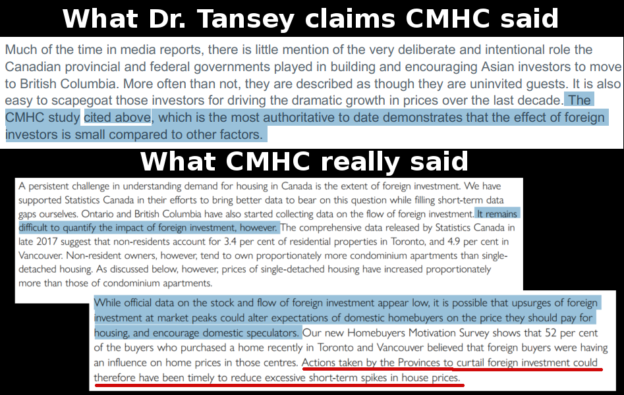

Fentanyl dealers launder their profits through Vancouver’s real estate market1)https://globalnews.ca/news/4149818/vancouver-cautionary-tale-money-laundering-drugs/ The influx of proceeds of transnational crime causes Vancouver’s home prices to soar causing a frenzy of speculation. This toxic demand then leads to eviction and homelessness. Eviction and homeless has been linked to increases in addiction2)William Damon, Ryan McNeil, M -J Milloy, Ekaterina Nosova, […]

Read More →